🍿 Next Episode.. no good options

Netflix's latest subscription numbers herald an era of change for the streaming giant

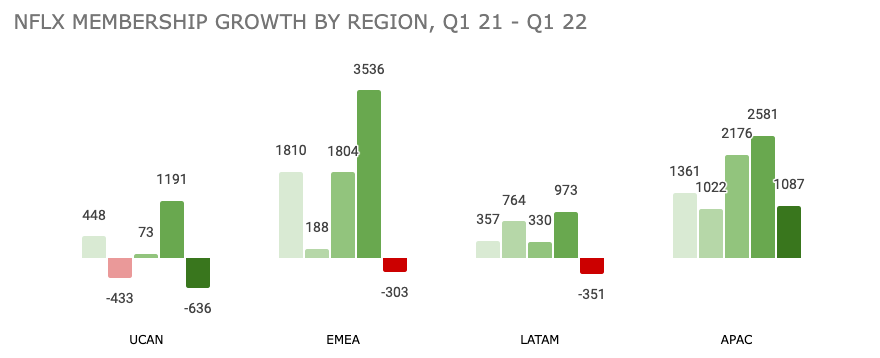

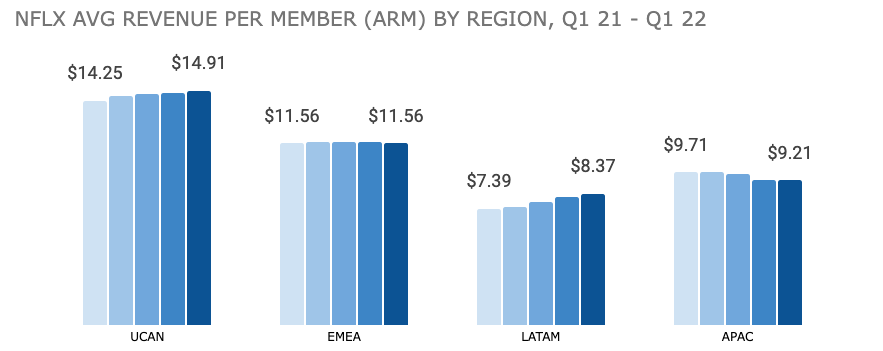

Netflix (NFLX) announced a net decline in subscribers for the first time in ten years, sending their stock price tumbling 37% last week. The company lost subscribers (or members, as they’re referred to in NFLX financials) in every region except APAC, while APAC growth declined 58% QoQ.

Troublingly, average revenue per member (ARM) has remained stagnant or declined, suggesting a monetisation gap that urgently needs to be solved if NFLX want to continue the stock market tear they’ve maintained the past few years.

Ignoring macro factors, here are three big issues facing NFLX - and streaming services in general.

LIMITED HEADROOM

NFLX are competing for the attention and eyeballs of households comfortable with dropping $20 a month for an ever-more limited catalog. There’s two sub-problems here:

there are fewer households willing or able to subscribe, who aren’t already, and

the remaining market share just don’t see value in NFLX’s content

Focusing on 2, not only has NFLX lost their status as ‘streaming aggregator’ (MCU series migrated to Disney+, Rick & Morty migrated to HBO...), their own content is starting to look formulaic. Tune in on Christmas Day for 20,000 different takes on the exact same movie, or just look at any NFLX Original reality show. Contrast this with services like Disney+, where entertaining and engaging content is available for all ages, or Amazon Prime Video, where a strong subsidiary offering (get a Prime subscription alongside) and limited IPs (e.g. Clarkson’s Farm) can drive strong interest continuing to subscribe.

Netflix’s trigger-happy attitude towards cancellations is also a problem; intriguing content gets canceled just as fans start to invest (looking at you, Archive 81), and this hard limit to engagement prevents cult followings, which can help sustain a subscription the way GoT did for HBO.

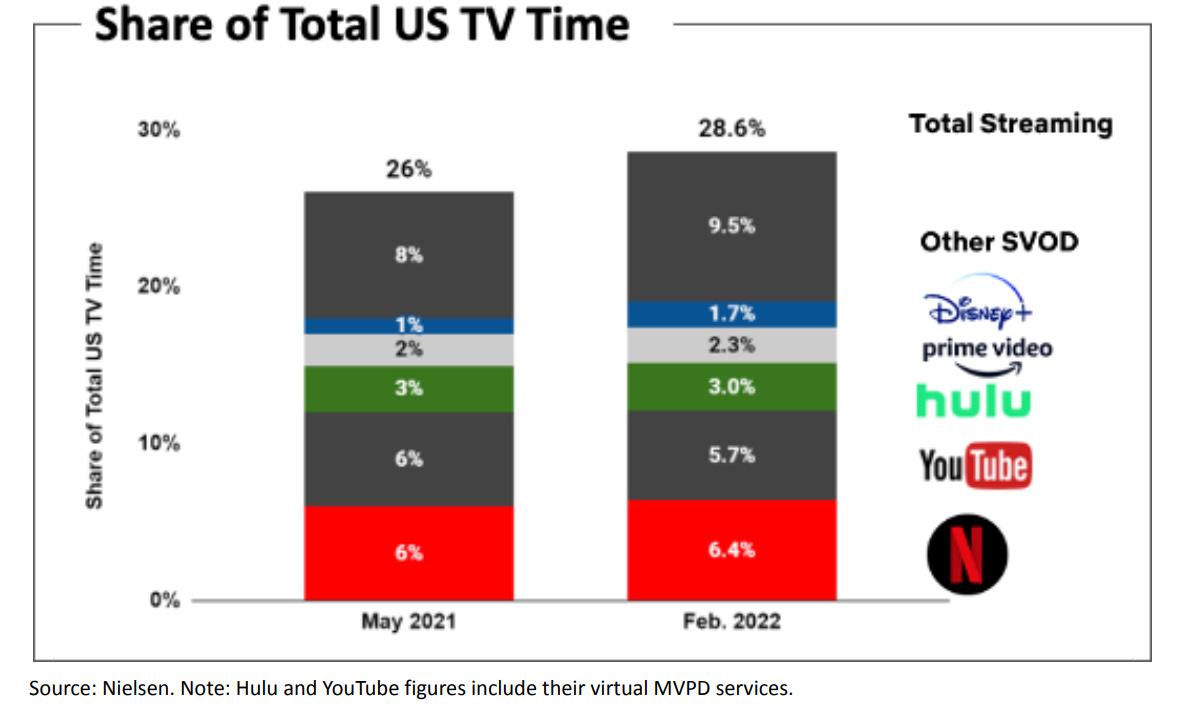

Finally, it’s important to remember that NFLX aren’t just competing with other streaming companies; they’re competing for our attention with real life. As pandemic regulations ease and life returns to a ‘new normal’, NFLX will need a strong value proposal to ensure subscriber growth, or even retention.

One way NFLX can compete is by lowering prices. Most public companies would - and should - balk at the idea, but NFLX have a very good option that they have long avoided; a cheaper, ad-supported subscription. Ben Thompson over at Stratechery makes the case much better than I can, so please take a look at that.

INTENSE COMPETITION

We’ve touched on this above, but to expand; there are well over 200 streaming subscription services out there; these are just the well-known ones, so let’s say ~1k services exist. Netflix is competing both at the top of their customer segmentation (Disney+, HBO Go/Max, Peacock..) and the long-tail in niches like Anime (Crunchyroll) or Kung-Fu (Hi-Yah!). M&A is an option for the latter, but the former is a challenge especially given NFLX’s lethargic content strategy. Netflix’s own Q122 Shareholder letter suggests that the competition is growing faster than they are.

PASSWORD SHARING

NFLX’s own “this u?” moment above encapsulates how the company at first encouraged, and then quickly realised the problem with password sharing: lots of eyeballs, only a few pay. By their own estimates, >100M households ‘share’ a NFLX password. It would be a very bad call to crack down on sharing within households, but it makes quite a bit of sense to monetise sharing beyond the household.

It seems NFLX are testing just that - they are charging primary account holders in some markets a fee for password sharers outside the same household. That this is being rolled out in LatAm - the only market with meaningful ARM growth - is questionable, but more importantly there are two big questions that I think will cause trouble:

how on earth will NFLX enforce this? How will they differentiate between ‘cheapskates’ and someone catching up on Stranger Things during a business trip abroad?

How likely is it that these ‘sharers’ will convert to paid subscribers? My money is on “Not very”.

So what’s a company to do? The reality is any step taken now only pays off in a year or two, and to me cracking down on password sharing is an outright bad call since enforcement is dodgy and I don’t think it will actually lead to paid subscriber conversions.

So what remains? Content.

See not every company is a tech company. At one point in my Airbnb tenure, we would say we aren’t a tech company, but rather a travel company enabled by tech. I think the same is true for NFLX:

NFLX isn’t a tech company, it’s a content company enabled by tech.

I think that’s the secret sauce, and NFLX have a few ways forward:

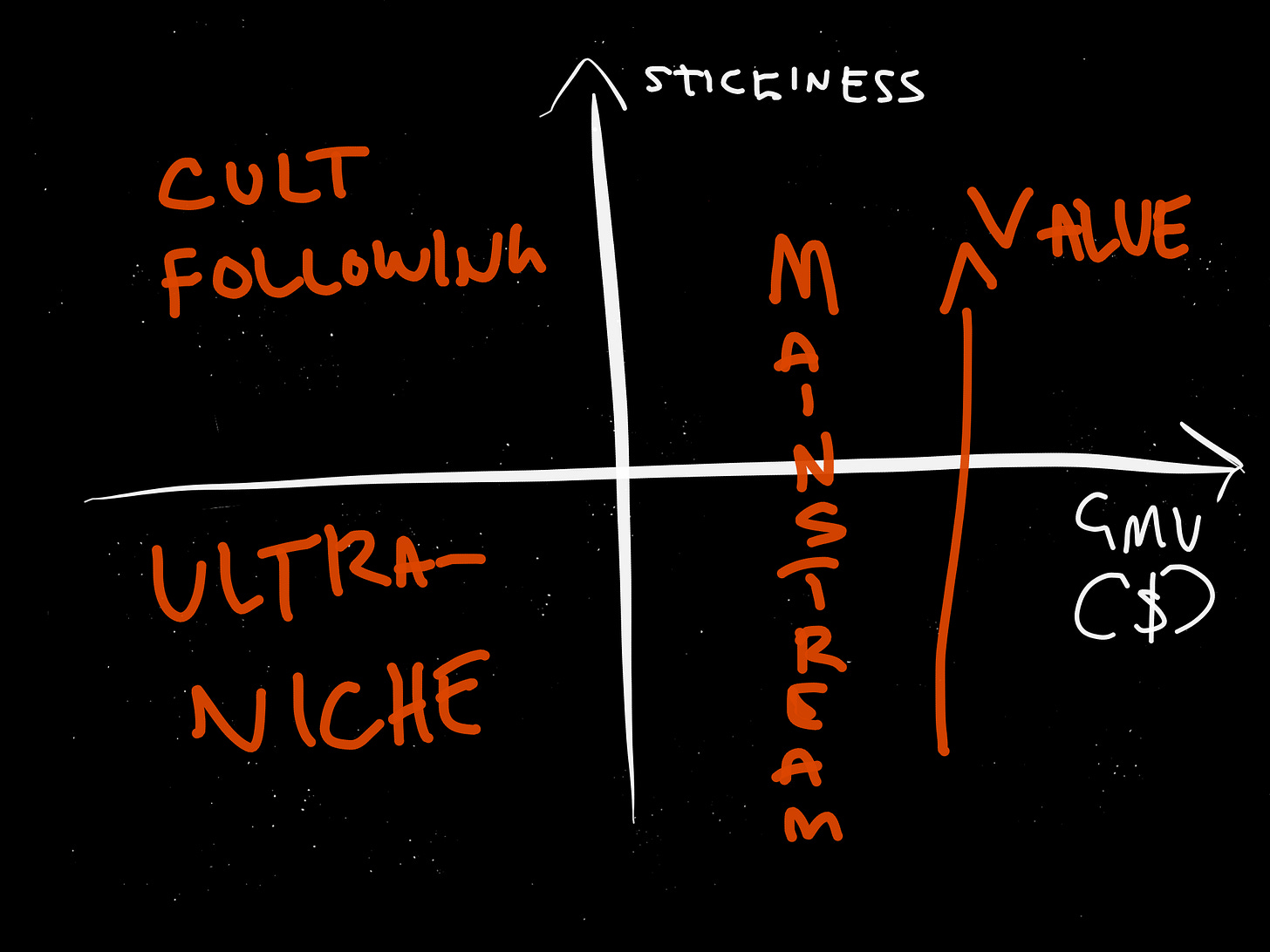

Go deep again, there are well over 200 streaming services out here, many long-tail. I would be looking at torso-to-tail market segments with a) acceptable production economics and b) high purchase intent/stickiness. Counterintuitively, these might have a smaller GMV, but these ‘cult following’ islands represent inelastic, consistent demand. The obvious route would be M&A/rights (e.g. buy WWE, cut a deal on anime rights)

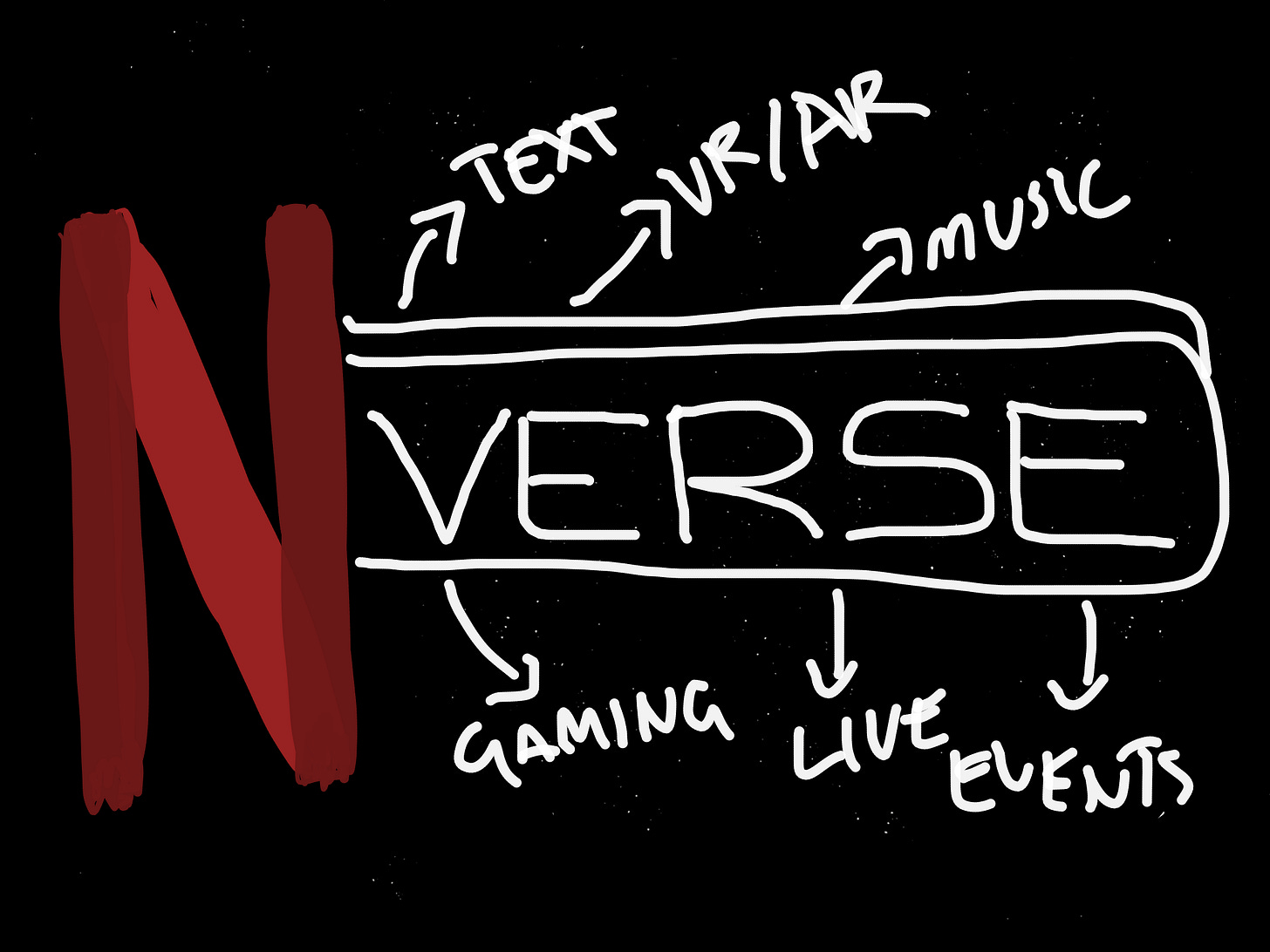

Go across if we’re competing for eyeballs and attention (and competing with real life), then most forms of entertainment are fair game - pun intended as NFLX have begun a foray into gaming. Aside from acquiring gaming studios, I think they should be looking at an AR / metaverse play to entertainment in general; imagine an immersive menu of options to choose from, both wholly hosted in your device/tv and as part of your broader interaction with the real world. This could easily evolve into tie-ins with real-world events - collaborative storytelling comes to mind.

Both are good options. Unfortunately, the path ahead has one big, hairy problem: NFLX is probably doomed to become exactly what it has seem diametrically opposed to being since inception. Expansion sideways turns NFLX into just another bloated VOD channel, albeit with a search layer and recommendation engine. Expansion in all directions makes NFLX lose their identity; what is their core purpose, if they’re playing in all markets?

Let’s not forget that this can be done, and done well. Apple started as a computer hardware company, and now is a multi-platform giant with increasing ambitions as a service provider. Mcdonald’s vertical integration to minimise costs is the stuff of business case legend. Though the path is fraught with danger, one thing NFLX has proven is that their leadership are comfortable making hard decisions that prioritise longer-term outcomes, and are stubbornly bullish on their own theses. I hope this remains true, but for now I’m considering downgrading my own subscription until the content library becomes compelling versus newcomers.

It’s kind of amazing how it took a subscriber net loss before management noticed (and decided to act to counter) other much cheaper much better alternatives out there like amazon prime.

I’ve always wondered how Netflix managed to put up with that kind of price premium, when amazon prime was offering the same at 10% of the cost, with access to prime delivery!! 🤯

My friends shared netflix but preferred to sign up individually to amazon prime given the low cost and prime delivery benefits.

Disney was in at 50% price point with their popular trademark shows.

It was about time netflix gave way. Took a while though!